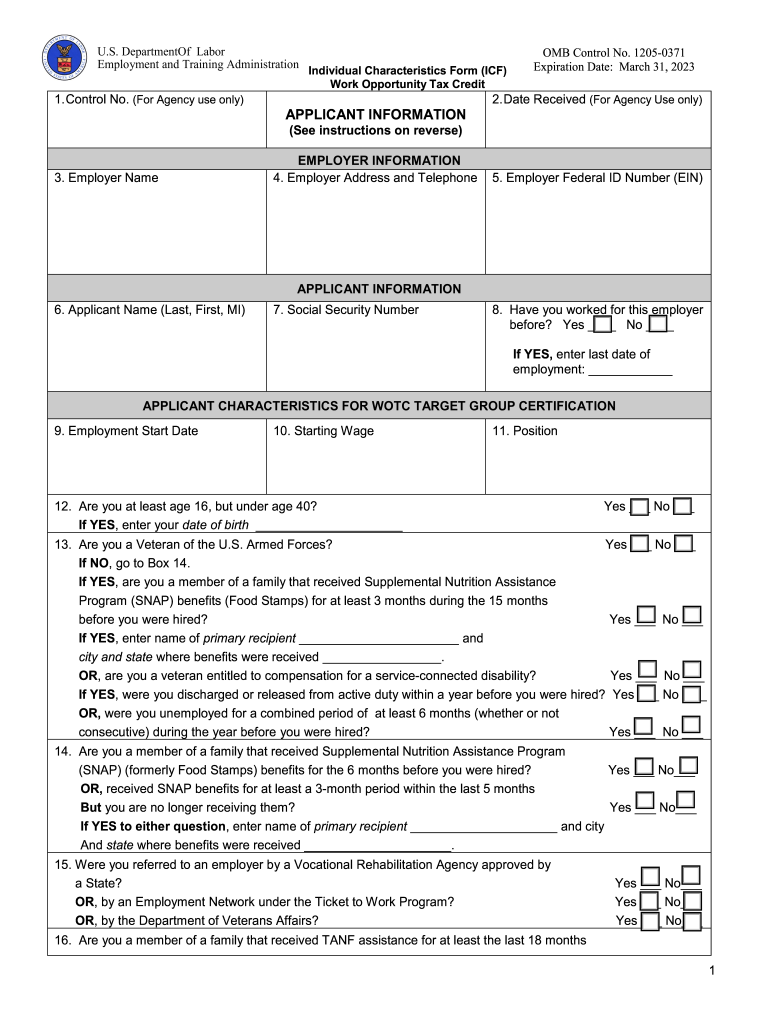

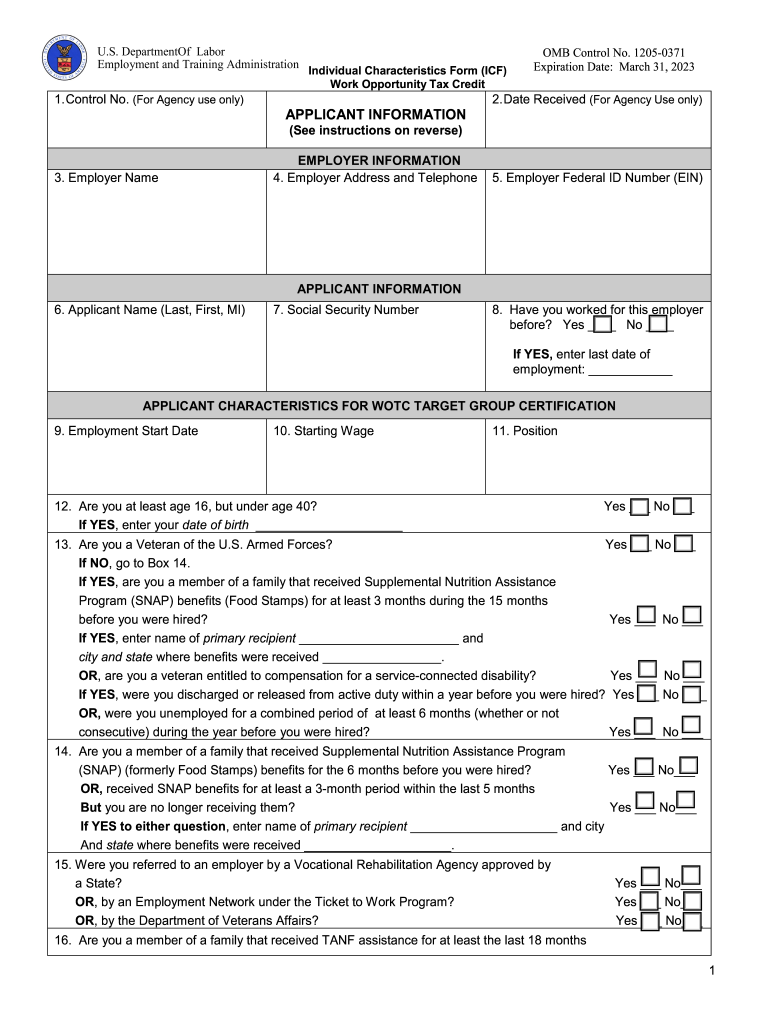

DoL ETA 9061 2016-2024 free printable template

Get, Create, Make and Sign

How to edit form 9061 online

DoL ETA 9061 Form Versions

How to fill out form 9061 2016-2024

How to fill out form irs 8850 form:

Who needs form irs 8850 form:

Video instructions and help with filling out and completing form 9061

Instructions and Help about form 9061 work opportunity tax

Has this ever happened to you when you're filling out a form that someone else created in Word while word forms may look good if they don't behave well when you fill them out they can cause frustration on the part of the form filler and perhaps even incorrect data for you to create great forms in word first you'll need to add the developer tab on the file tab we'll choose options and then customize ribbon just click the checkbox next to the developer tab it should be the only one unchecked if it's not already added to your ribbon you won't need most of what's here we're just going to be using some buttons in the controls group on the insert tab I'm going to choose table and then convert text to table that gets our data in a more organized format it's a little easier to work with in a table you now we can start putting in our form fields on the Developer tab in the controls group click on the plain text control that's this one here if you choose the other text button rich text control it'll allow form fillers to use bold italic color whatever to format their entries if that's what you want you can certainly use it most of our form fields will work fine with this type of text control now click on design mode to change the default instructions after adding each field click on properties and then name the field if you know how to use XML data these tags can be used in XML schemas to process the data programmatically whether that your intention having the tag names can make your forms easier to decipher in design mode you can see the tags disappear when I click design mode off, and we'll just put that back on here I'm just clicking inside the default instructions to put in my own you have to be in design mode to do this you can also use legacy form tools to get more control we'll do that here for the zip code to limit the number of digits and get it formatted properly you'll use a drop-down list control here to select the member type you and use the properties to identify these selections we'll just click Add for each one we want to have you could also put a checkbox control here too you now let's add a date picker for the submission date you, and we're done adding our fields we want people to fill this out and then print it and sign it so make this row a little taller you and remove all the borderlines we'll just add the bottom ones back here and here too so let's take this out of design mode and see what we have there's one more step to making this form easier to use on the review tab will choose to restrict editing then we'll just click this box and tell a word to only allow filling in forms, and then we'll click here to start enforcing protection you can choose to give it a password or not that's up to you this is what we'll send people to fill out I'll just basically type in tab some legacy form fields might not tab well, so they may need to click into them from a protected form if you want to capture the data you can copy and paste it to...

Fill form 9061 pdf : Try Risk Free

People Also Ask about form 9061

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 9061 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.